Rumored Buzz on Life Insurance In Toccoa Ga

Table of ContentsMore About Commercial Insurance In Toccoa GaUnknown Facts About Commercial Insurance In Toccoa GaEverything about Life Insurance In Toccoa GaHealth Insurance In Toccoa Ga Can Be Fun For Everyone

A monetary advisor can likewise aid you choose just how finest to accomplish objectives like conserving for your child's college education and learning or repaying your financial obligation. Monetary consultants are not as well-versed in tax obligation regulation as an accountant could be, they can use some guidance in the tax obligation planning process.Some monetary experts use estate planning solutions to their clients. It's important for economic advisors to stay up to date with the market, financial problems and advising best practices.

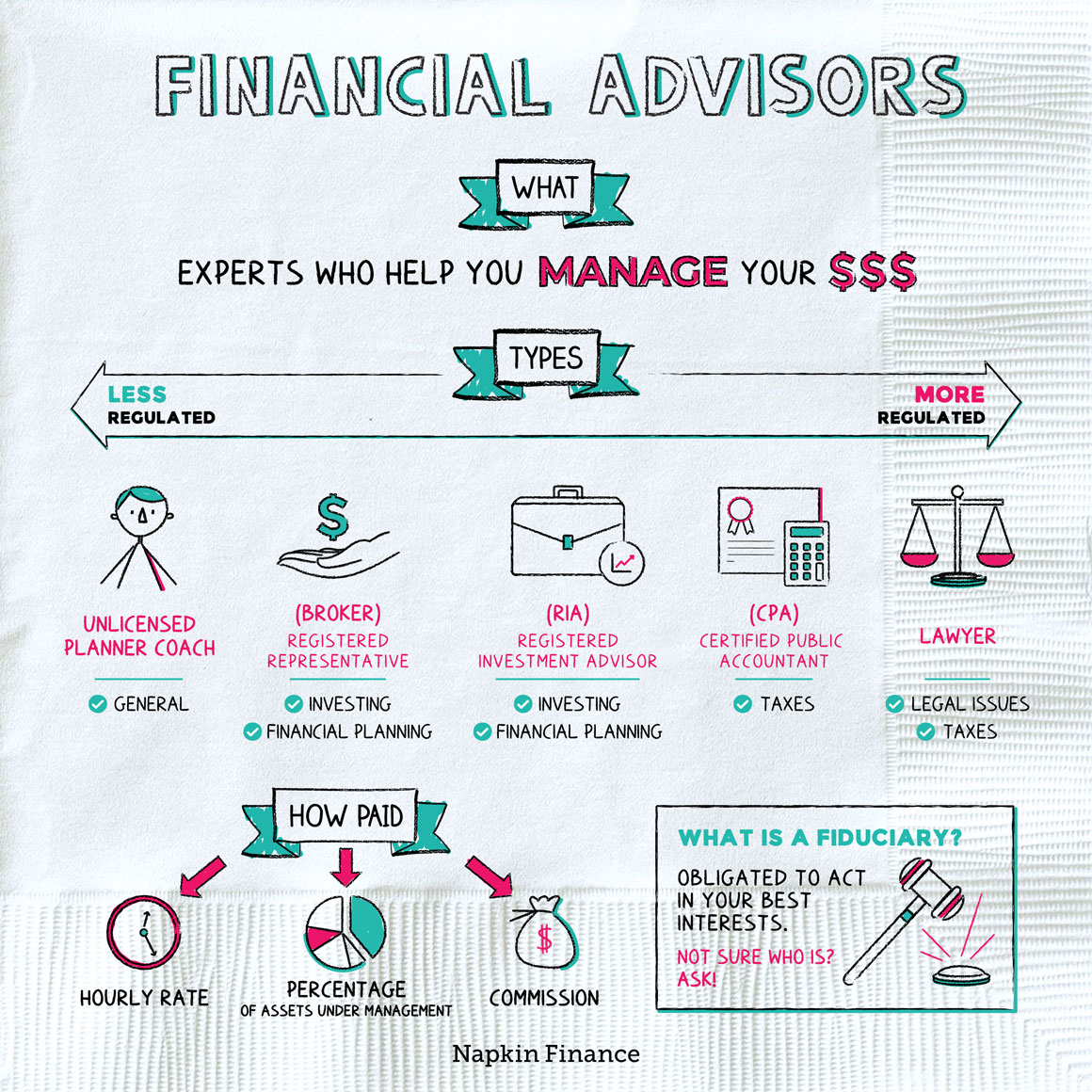

To offer investment products, consultants need to pass the relevant Financial Market Regulatory Authority-administered exams such as the SIE or Collection 6 tests to get their accreditation. Advisors that desire to market annuities or various other insurance coverage items have to have a state insurance coverage permit in the state in which they prepare to market them.

Health Insurance In Toccoa Ga Things To Know Before You Buy

You employ an expert that charges you 0. Since of the regular cost structure, numerous consultants will certainly not function with clients who have under $1 million in assets to be managed.

Investors with smaller portfolios could seek a financial consultant who bills a per hour cost as opposed to a portion of AUM. Per hour charges for advisors commonly run between $200 and $400 an hour. The even more complicated your monetary circumstance is, the more time your expert will certainly need to dedicate to handling your properties, making it extra pricey.

Advisors are competent experts that can aid you develop a plan for monetary success and execute it. You may additionally take into consideration getting to out to an advisor if your personal financial circumstances have actually lately become more complicated. This could imply purchasing a house, marrying, having kids or receiving a huge inheritance.

Unknown Facts About Life Insurance In Toccoa Ga

Prior to you satisfy with the expert for a preliminary assessment, consider what services are most essential to you. You'll want to look for out an advisor who has experience with the services you desire.

The length of time have you been encouraging? What service were you in before you entered into monetary advising? That composes your common client base? Can you supply me with names of a few of your clients so I can review your services with them? Will I be collaborating with you directly or with an associate advisor? You might additionally want to look at some sample financial strategies from the consultant.

If all the samples you're provided coincide or similar, it might be an indication that this expert does not correctly tailor their recommendations for each customer. There are three major types of monetary advising specialists: Certified Monetary Organizer experts, Chartered Financial Experts and Personal Financial Specialists - https://experiment.com/users/jstinsurance1. The Licensed Financial Organizer specialist (CFP specialist) accreditation shows that an expert has actually met an expert and moral criterion established by the CFP Board

The Greatest Guide To Final Expense In Toccoa Ga

When choosing an economic consultant, consider someone with a specialist credential like a CFP or CFA - https://www.artstation.com/jstinsurance14/profile. You could additionally take into consideration an expert that has experience in the services that are crucial to you

These experts are typically riddled with conflicts of passion they're extra salesmen than experts. That's why it's important that you have a consultant who works just in your benefit. If you're trying to find a consultant who can see this page absolutely supply real worth to you, it is very important to research a variety of prospective options, not merely pick the very first name that advertises to you.

Currently, lots of advisors have to act in your "finest passion," but what that requires can be almost unenforceable, other than in the most outright cases. You'll require to locate a real fiduciary.

"They must confirm it to you by revealing they have actually taken major continuous training in retired life tax obligation and estate planning," he claims. "You need to not spend with any kind of expert who does not invest in their education and learning.